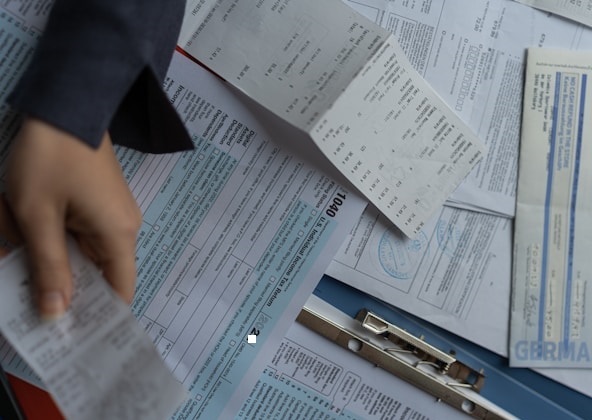

The first thing you need to know about online casino winnings is that every penny you pocket from playing at an online casino is subject to taxation. In fact, you are required by law to report all gambling winnings to the IRS.

This includes the fair market value of any non-cash prize winnings you earn while playing at an online casino. These would include such items as perhaps a car, or a trip that was included as a prize in an online casino competition.

Understanding Tax Rules for Online Casino Winnings in the USA

Suppose you are lucky enough to hit for a major, life-altering win while playing an online casino game. If that is indeed the case, you will receive an official Form W-2G from the online casino to use to report your winnings to the IRS.

Items that would result in the issuing of a Form W-2G include $600 or more on a horse race (if the win pays at least 300 times the wager amount); $1,200 or more at bingo or on a slot machine; $1,500 or more at keno; and $5,000 or more in a poker tournament.

Online casino table games such as blackjack, roulette, baccarat, or craps are exempt from the W-2G rule.

In the instance of a major win, the online casino operator will automatically deduct 24% of your winnings on the issued Form W-2G and submit that amount directly to the IRS. It is an estimated tax. You might end up paying more tax, or you could receive a refund. It all depends on the amount you win.

However, even if you don’t get one of the W-2G forms, it is still your responsibility to report all income earned from online casino winnings to the IRS.

You aren’t permitted to subtract the amount you wagered to garner those winnings from your windfall. However, you are permitted by US tax laws to claim your gambling losses as a tax deduction. In order to do so, you must provide a detailed itemized list of all of your online casino losses with your tax return.

You can’t use gambling losses to create a deficit. So if you’ve had a $5,000 win at the online casino, but over the course of the year lost a total of $10,000 gambling at online casinos, you can only claim up to $5,000 in losses, enabling you to at best break even.

You can only utilize gambling losses to minimize gambling winnings on your tax return. You can’t claim gambling losses as a tax deduction against any other form of income you earn.

Professional gamblers are able to claim business expenses against their online casino earnings. However, they must register as self-employed on their tax return in order to claim as a pro.

Taxes on Online Casino Winnings in New Jersey

We at NJ.Bet have always been asked whether online casino winnings are taxable in NJ. The answer is yes! In New Jersey, you’ll need to pay both federal and state taxes on any real money online casino winnings. Here’s a simple breakdown of what to pay and how it is calculated with examples:

Federal Tax:

No matter where you gamble, the IRS wants a cut. If you win big—like $1,200 or more from a slot machine, $1,500 from keno, or $5,000 from a poker tournament—you’ll be taxed 24% on those winnings. Even if you don’t get a W-2G tax form from the casino, you still have to report all your winnings on your federal tax return.

New Jersey State Tax:

On top of that federal tax, New Jersey state also taxes your winnings. The state tax rate depends on how much you make overall, ranging from 1.4% to 10.75%. So, if you hit a big win online, like $3,000 from a slot, you’ll need to report that on your New Jersey tax return too.

What is Withholding?

If you win a large amount, like $5,000 or more, the casino might automatically take 24% for federal taxes. However, New Jersey doesn’t usually withhold state taxes upfront, so you’ll need to remember to pay that when you file your taxes.

Example:

So, let’s say you visit one of the recommended online NJ casinos and win $2,000 playing online slots. The casino might not take anything out right away, but you’re still responsible for reporting that on both your federal and New Jersey tax returns.

The only thing we can recommend here is to find and play games with the best odds, and high RTP slots. You can also use listed here deposit casino bonuses to increase your chances of winning.

- Cashback Offers

- Minimum Deposit Casinos

- Online Casino Payment Methods Compared: Best Casino Deposit and Withdrawal Options for NJ Players Reviewed

- Best Slot Sites

- Casino Promotions

- New Casinos in NJ

- NJ Casino Apps | TOP Mobile Casinos in New Jersey

- NJ PayPal Casinos

- No Deposit Bonuses

- Casino Rewards & VIP Programs